Modern Workflows for

Trading Analytics

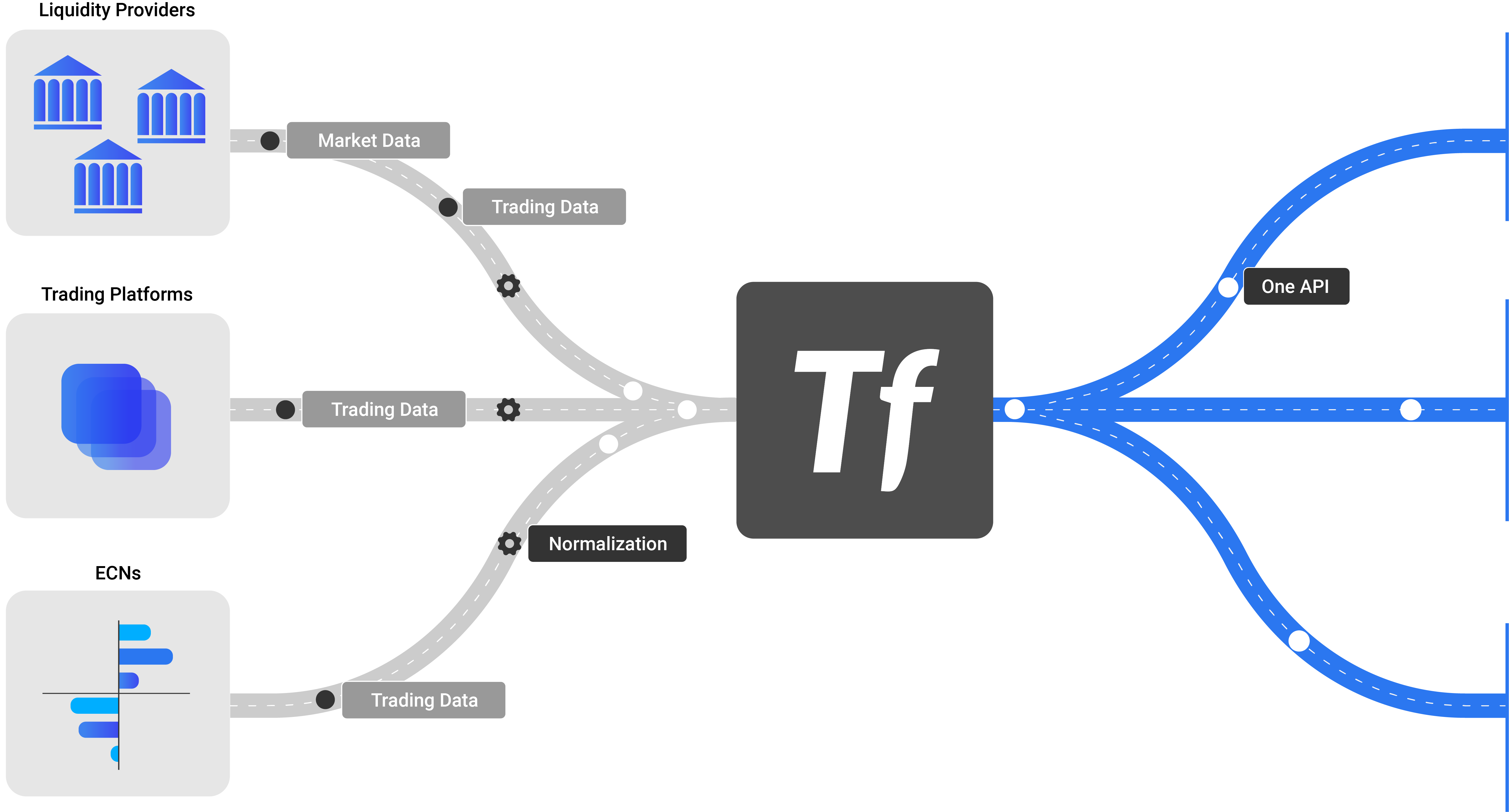

Connect to 16 of the largest FX liquidity providers, ECNs & trading platforms over a single Data API. Query your trading data, analyse & collaborate without friction.

Connect to 16 of the largest FX liquidity providers, ECNs & trading platforms over a single Data API. Query your trading data, analyse & collaborate without friction.

Trading analytics is overly complex. Underlying trading data is difficult to process and is dispersed across liquidity providers, trading platforms & ECNs. We have built a secure API platform to simplify things.

Tradefeedr maintains normalized data connections to all your providers. Our APIs deliver unified, analysis ready, enriched trading & market data so you can focus on what matters - data driven decision making.

For Traders - no IT required

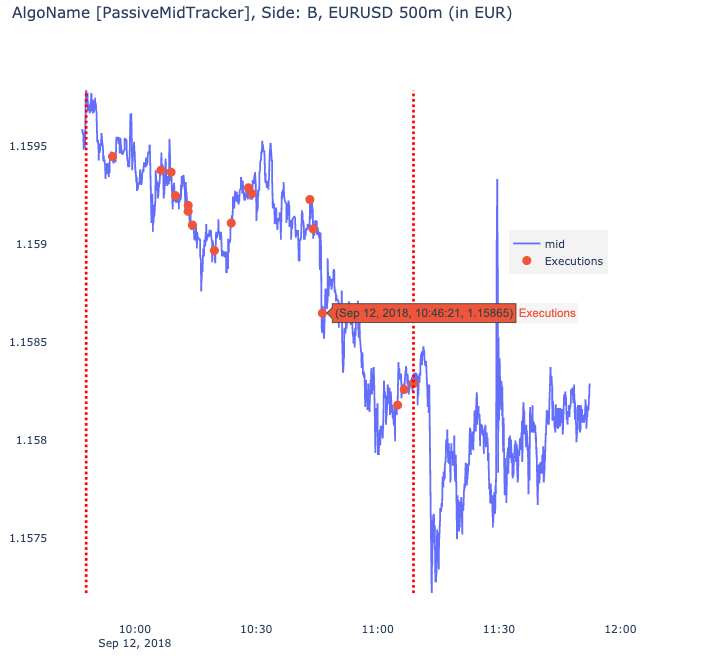

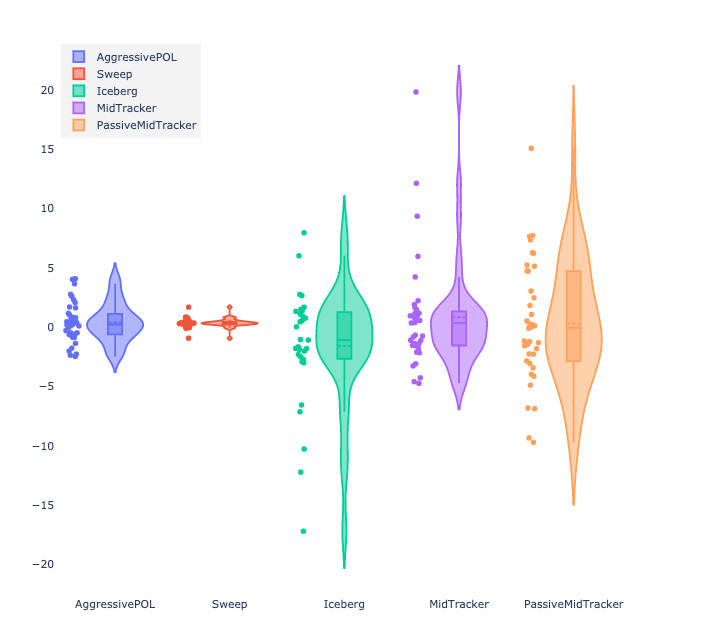

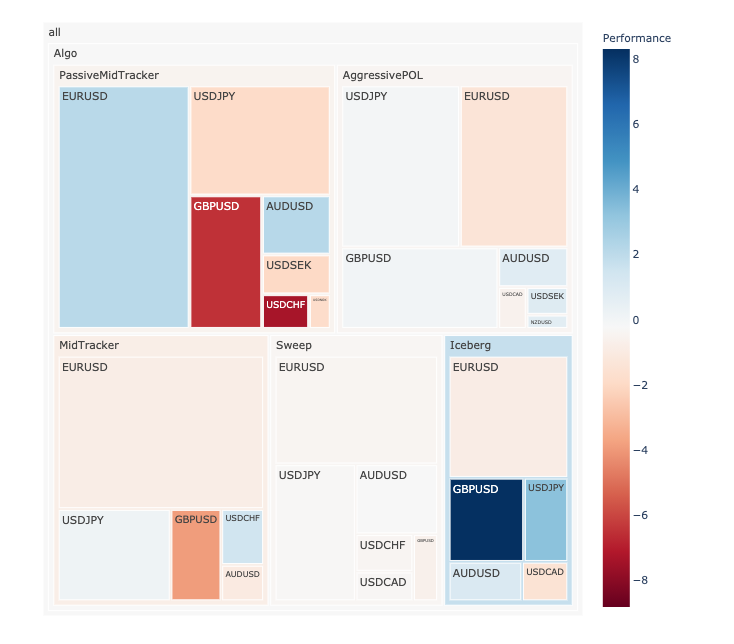

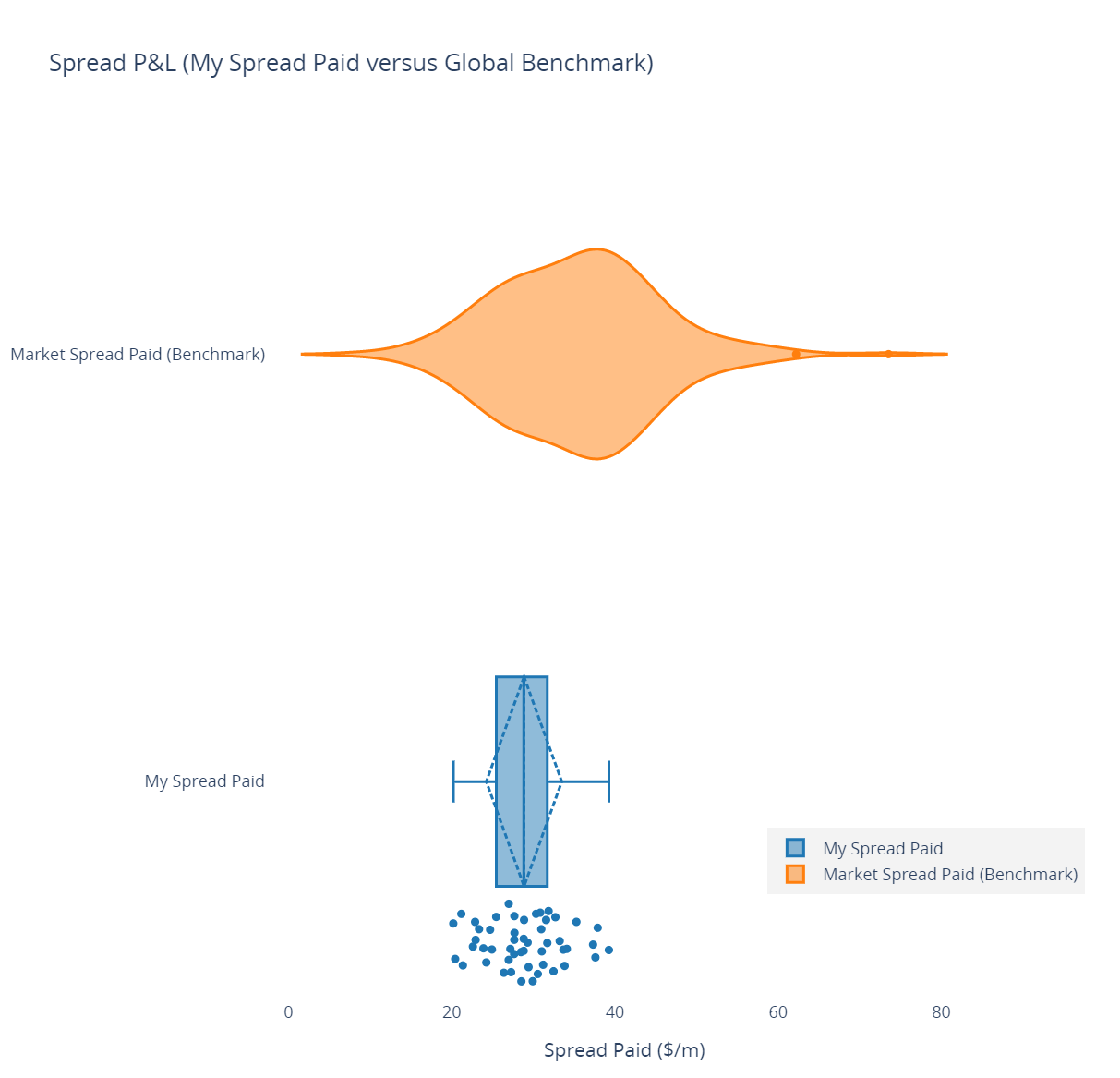

Easy start. Select from a library of pre-existing analytics templates covering everything from transaction cost analysis, custom best execution policies and liquidity management.

Customise your Analysis. Build your own dashboards using components.

Reports. Automated email reporting and alerts.

For developers - low code

Take advantage of a consistent data model. Focus on your business, not on data engineering – all underlying trading data has been normalized to be comparable across providers.

Workspace. Integrated Python development environment. Powerful APIs to run complex data analysis in one API call.

Build on existing templates. Use standard building blocks to build analytics pipelines that suit your business needs easily.

Open. Connect directly to APIs and extract raw transactional tick data and calculated statistics to use in your own internal applications.

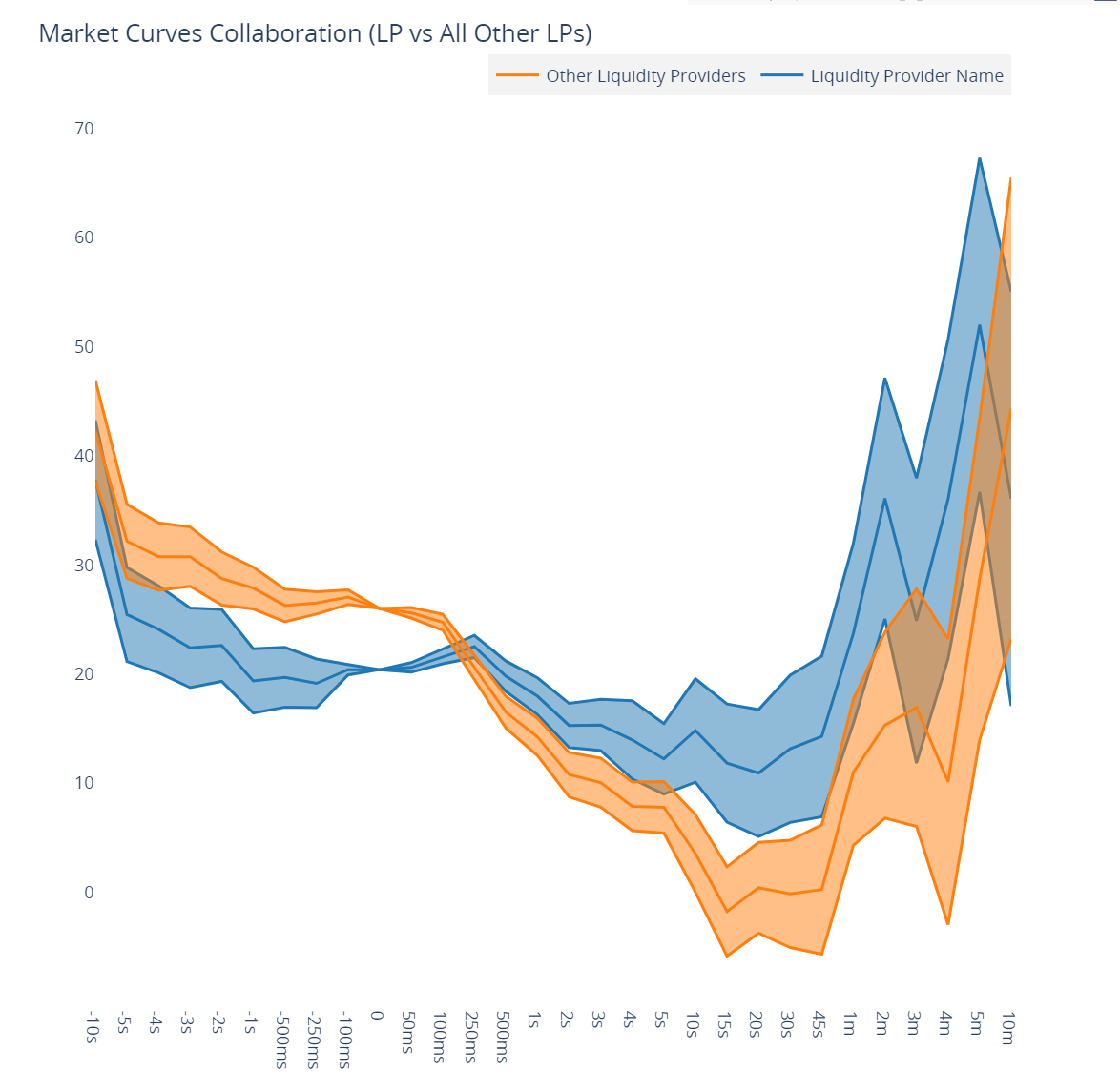

Engage with your Liquidity Providers

Work with your Peers

Conor Daly - EMEA Head of eFX Sales

Goldman Sachs

Nick Robinson - Head of Trading

Insight Investment Management

Jeremy Smart - Global Head of Distribution

XTX Markets

Christian Gressel - Global Head of Electronic Sales Trading

UBS

Richard Elston - Head of Institutional

CMC Markets

Adam Blemings - Head of Trading

IG Markets

Ramy Soliman - Chief Strategy Officer

Z.com Global Markets